About Gojek & GoModal

Gojek is a super app with services like mobility, food delivery, and digital payments. Our merchants are a core part of the Gojek ecosystem and we want our merchants to grow their businesses. GoModal is the easiest way for our merchants to access a capital loan in Indonesia.

UX Problems

Small mom and pop restaurants (earning about $600 a month) don't have enough income documentation to get a loan from traditional banks. After GoModal was launched as an MVP, there were several problems related to the product which was solved by design.

Target audience

A typical merchant who is selling their food on GoFood has an income of IDR10,000,000 a month (translates to about $600.) Indonesian banks require a detailed income history to disburse loans and for that reason, our merchants don't have access to credit as openly as businesses.

First attempt to solve accessibility problem

In the middle of 2018, Gojek introduced capital loans under the branding of PMU. We partnered with Indonesian's largest bank. The bank was using the same unfavorable process to approve loan applications. Rejecting 70% of the loan application. Since the problem was unresolved, we ended this solution and decided to build GoModal to solve credit accessibility.

User Research

After the MVP built in partnership with the bank, our research team conducted foundational research. They shared several key learnings and the following two ended up being our key USPs.

Top takeaways from the research:

- Merchants were not proud to use credit to grow business: In Indonesia, taking a loan is seen as a bad thing. A way to solve this is to ensure loan application is a completely online process.

- Merchants earn daily and prefer spending daily: Merchants weren't confident enough to repay a large sum of money every end of the month and resisted taking credit.

UX solution

Modal in Indonesian means capital and Go is the prefix of Gojek products. Hence, the name GoModal. The term Modal was part of the foundation research.

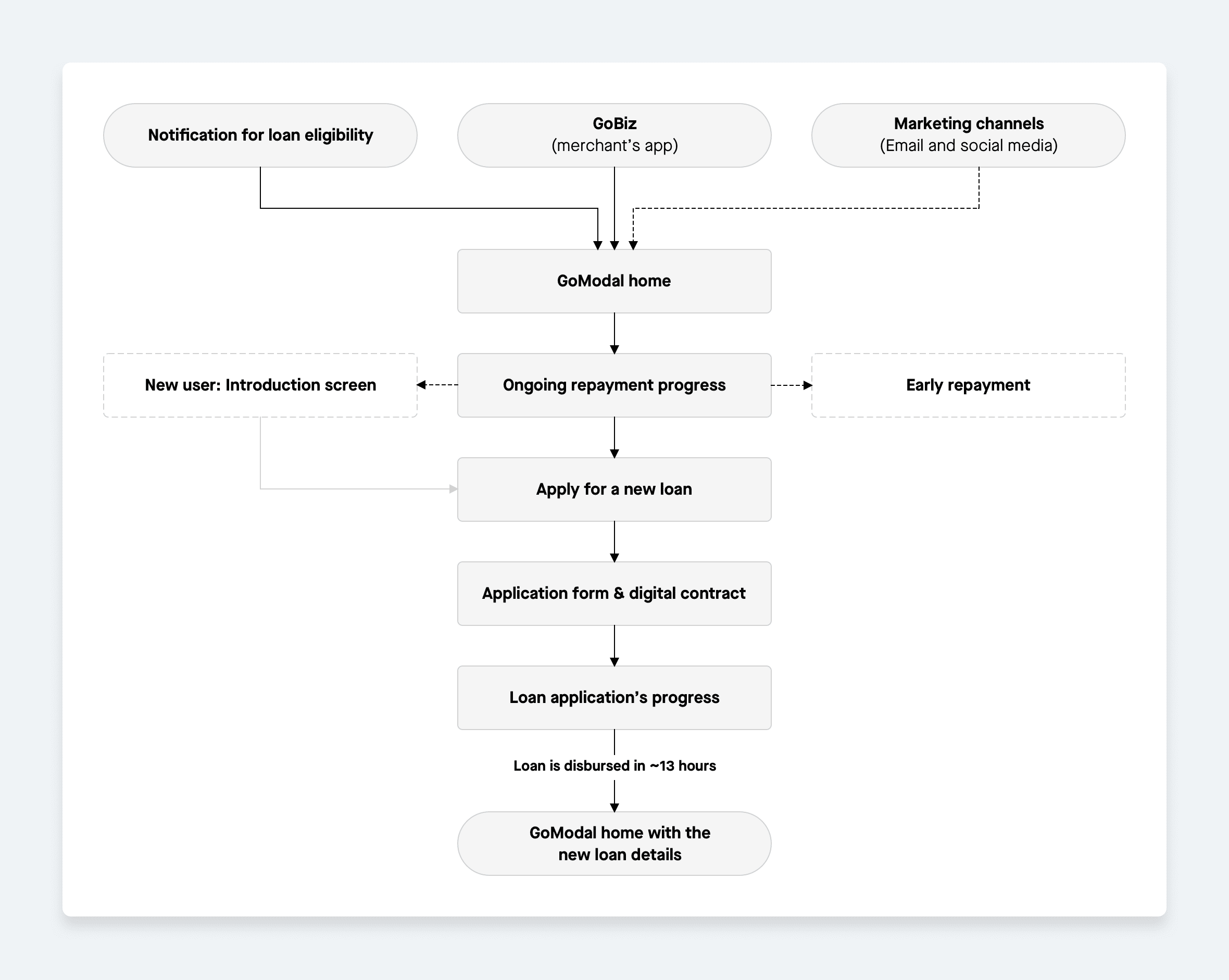

GoModal's loan application flow and GoModal home's navigation.

As part of building GoModal right we had several major projects as part of the overall experience.

- Move the entire application process online

- Break monthly repayments into daily deductions

- Introduce new GoModal home

Move the entire application process online

Using the GoBiz, merchants can access GoModal tile and apply for a loan within 5 minutes. Since all the loans are pre-approved, we can disburse loans in ~13 hours. Throughout the application process, merchants have visibility on what's happening with their application.

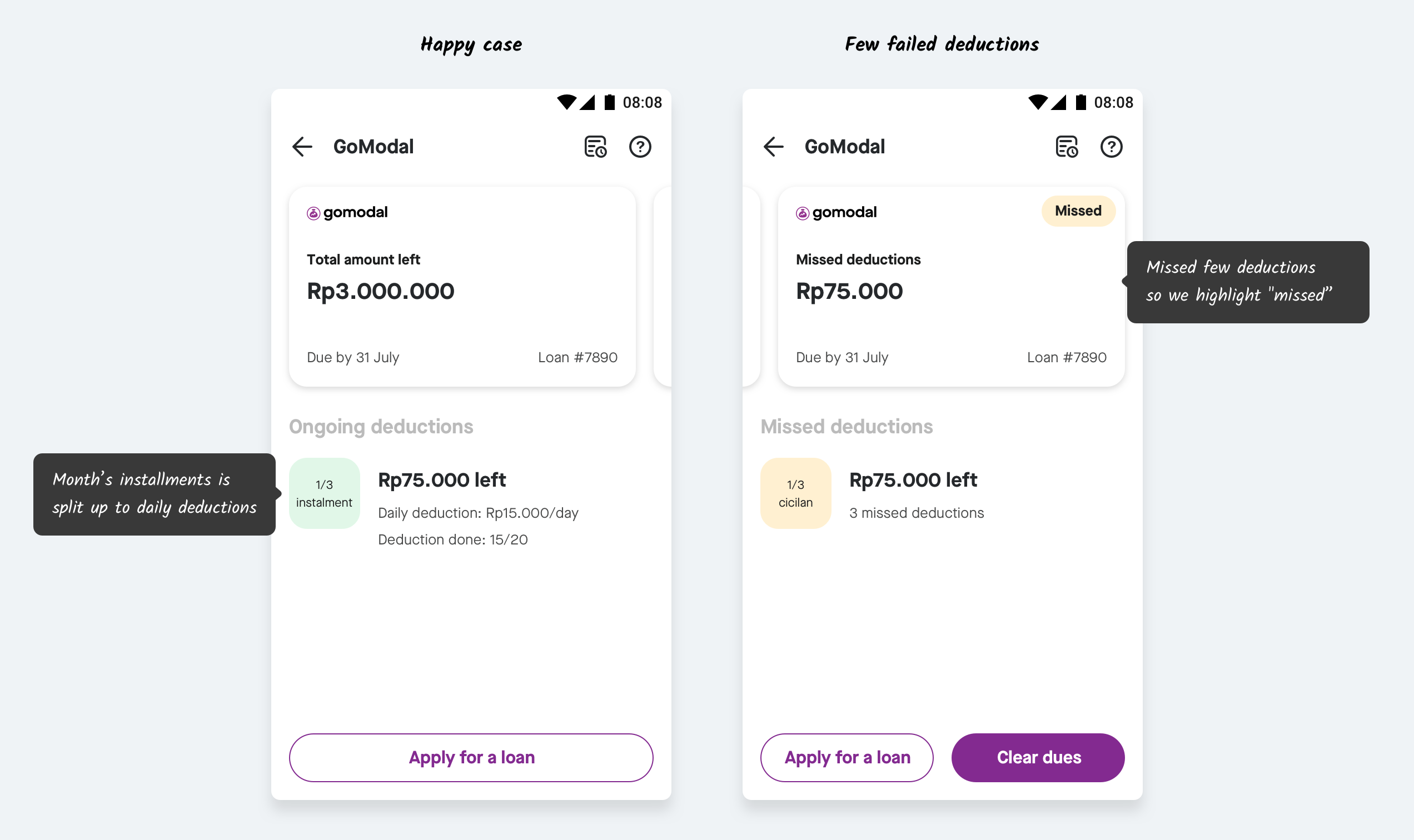

Break monthly repayments into daily deductions

Since merchants were not confident with paying installments monthly so we split them up into daily deductions. For example, an installment of $100 would be $5 a day. We educate our merchants about this from the very beginning.

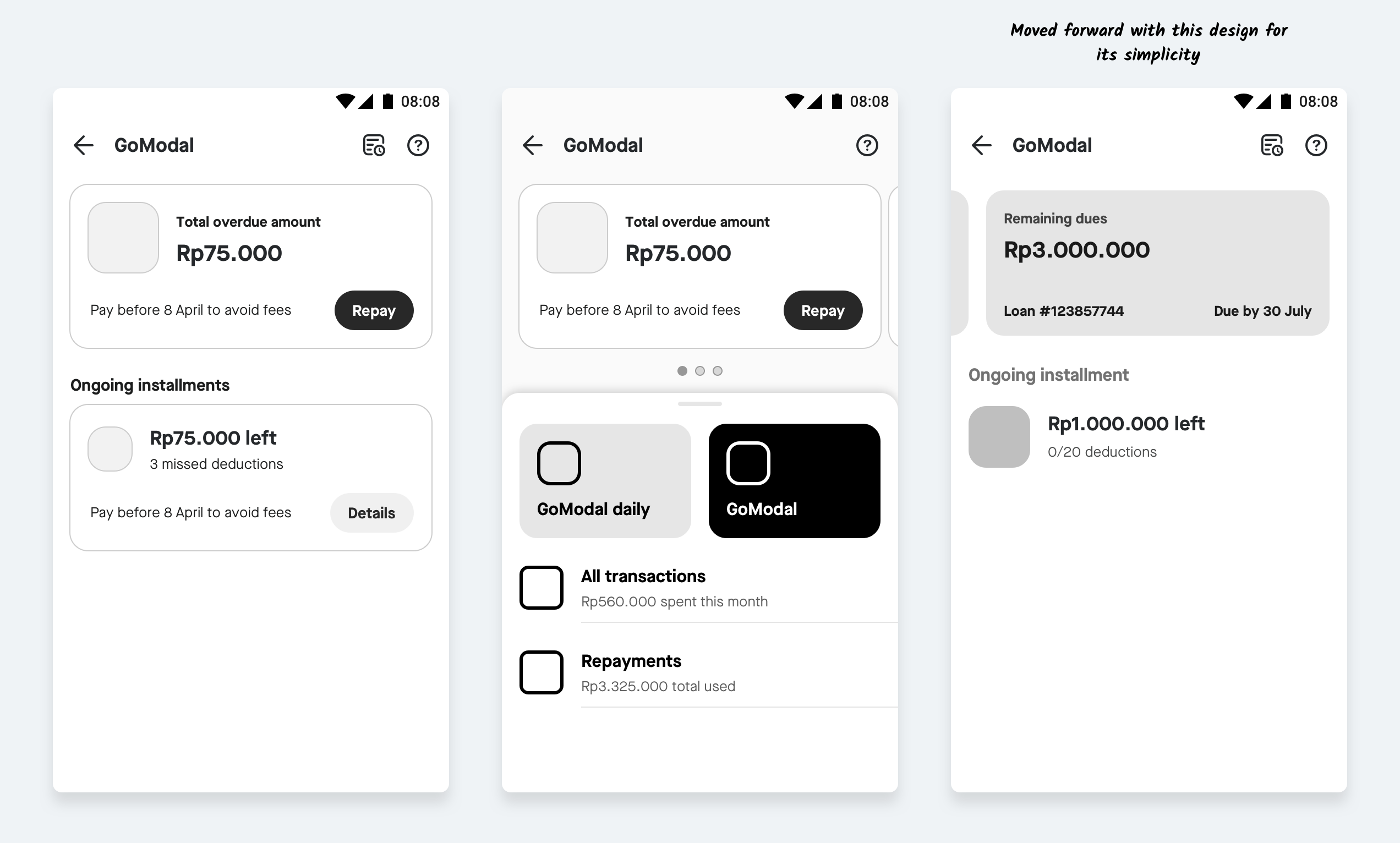

Introduce new GoModal home

After loans are disbursed, merchants have access to every loan detail. From how many deductions have happened to how much is overdue this month.

These were some of the variants we tried out and got feedback from internal teams. This was keeping in mind, scability of designs and modularity of designs.

Different states of GoModal home

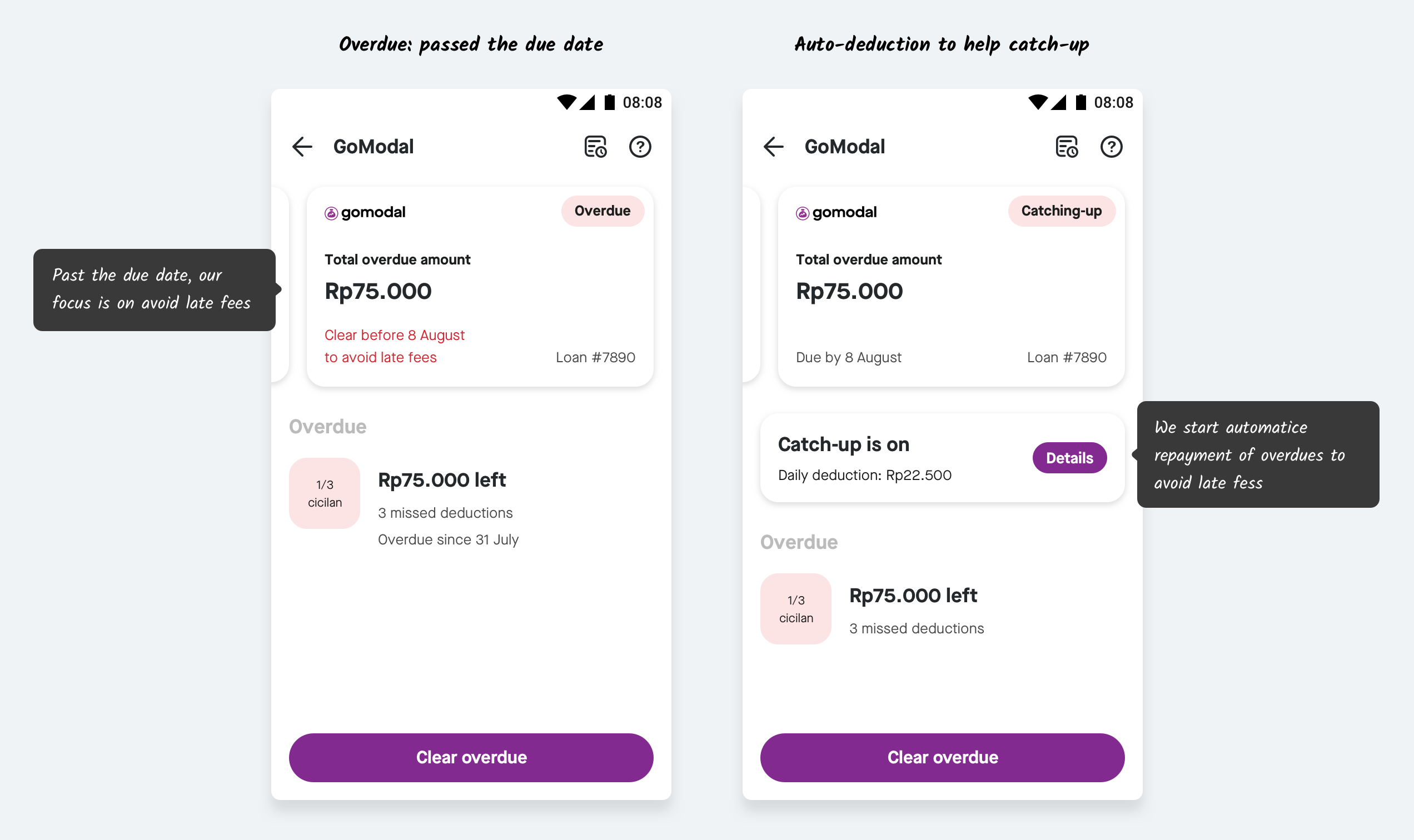

Each loan has a particular state. Ranging from overdue to ongoing (where eveything is working fine.) With each state, GoModal home presents the information which is most essential at the moment.

Here's the happy case, the daily deductions are successful and none have failed. Second is where the deduction had failed for fews days.

Overdue state is when merchant needs to manually repay through bank transfer. To avoid this hassle, we now do deductions for overdue amount.

Metrics

Since this was a large project, we were looking at high-level metrics like the number of loan applications. We had set up cadence with the customer support team to track what are the latest trends of problems our merchants are facing. We saw a 80% decrease in CS tickets for merchants requesting for repayment progress. Allowing our CS team focus on other higher priority issues.

What's next?

- Amidst Covid, GoModal users had shifted to loan usage from growing business to filling in for daily operational needs. Our next step is to help merchants with short-term financing in this situation.

- With such ease of application, we see a good fit for providing capital loans to our higher value merchant segments.